Compound interest is one of the most powerful financial concepts in the world. Whether you’re saving for retirement, investing for long-term growth, or comparing banking options, understanding how your money compounds helps you make better financial decisions. Our Advanced Compound Interest Calculator provides a detailed projection of your future value by considering principal, interest rate, frequency of compounding, contributions, withdrawals, investment duration, and growth scenarios.

This tool is designed for investors, students, professionals, and anyone who wants clear, accurate, and real-time financial calculations.

What Is Compound Interest?

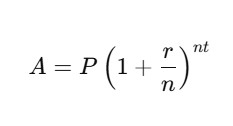

Compound interest is interest that is calculated on both the initial principal and the accumulated interest from previous periods. In simple terms, your money grows faster because you earn interest on top of interest.

Why it matters:

- Your investments grow exponentially, not linearly.

- Long-term savings become significantly larger.

- It shows how small contributions build serious wealth over time.

- Helps compare banks, mutual funds, stocks, crypto, and retirement plans.

The Advanced Compound Interest Calculator on this page is built to reflect real-life scenarios—giving you an accurate projection based on how interest truly grows.

How the Advanced Compound Interest Calculator Works

Unlike basic calculators, this tool considers multiple financial factors. You can customize:

✔ Initial Principal

The amount you start with.

✔ Annual Interest Rate (%)

Set the expected annual return from your investment.

✔ Compounding Frequency

Choose how often interest is added:

- Daily

- Monthly

- Quarterly

- Semi-Annually

- Annually

- Continuously

More frequent compounding = higher returns.

✔ Contribution Options

You can add:

- Monthly contributions

- Yearly contributions

- One-time extra deposits

This simulates real-life savings or investment plans.

✔ Withdrawal Options

Remove amounts regularly or occasionally to simulate expenses, emergencies, or income plans.

✔ Investment Duration

Set the number of years or months your investment will grow.

✔ Future Value Breakdown

After calculating, you receive:

- Total future value

- Total interest earned

- Total contributions made

- Principal vs. growth chart

- Year-by-year growth table

- Progress percentage through investment timeline

This level of detail gives you a complete financial picture.

Why Compound Interest Is So Powerful

Compound interest becomes more impactful when:

- Time is long

- Contributions are consistent

- Interest rate is high

- Compounding frequency is more frequent

Even small changes in these variables can make a huge difference. For example:

Example:

If you invest $10,000 at 8% interest for 20 years, compounded monthly, the future value becomes dramatically larger than simple interest.

This calculator helps you visualize such differences instantly.

- Enter your starting principal.

- Add your annual interest rate.

- Choose compounding frequency.

- Add monthly or yearly contributions if desired.

- Add optional withdrawals.

- Select your investment duration

- Click Calculate.

The results will show:

- Final future value

- Total interest earned

- Contribution summary

- Growth comparison

- Yearly or monthly growth table

- Graph of investment growth over time

This helps you make informed financial decisions without manual calculations.

Who Should Use This Calculator?

✔ Students learning finance

Helps understand the power of compounding.

✔ Investors & traders

Useful for projecting long-term returns.

✔ Bank and finance customers

Compare savings accounts, CDs, and investment plans.

✔ Retirement planners

Estimate future retirement savings with contributions.

✔ Business owners

Calculate compound growth for business reserves or funds.

✔ Anyone saving money

Shows how even small monthly deposits grow over time.

Benefits of Using This Advanced Version

Our tool is designed for clarity, accuracy, and reliability. Advantages include:

✔ Real-time calculations

✔ Ability to include contributions & withdrawals

✔ High-precision compound interest formula

✔ Multiple compounding frequencies

✔ Graphs for better understanding

✔ Year-by-year breakdown

✔ Mobile-friendly modern design

✔ Zero math skills required

Frequently Asked Questions (FAQ)

1. Is compound interest better than simple interest?

Yes. Compound interest grows money much faster because interest earns interest.

2. Can I use this tool for retirement planning?

Absolutely. It’s ideal for projecting long-term 401(k), mutual funds, and savings growth.

3. Which compounding frequency is best?

Daily compounding gives the highest return, but monthly and quarterly are most common in banking.

4. What interest rate should I use for investments?

Common estimates:

- 6–10% for stocks

- 2–4% for savings accounts

- 4–7% for bonds

- 5–8% for balanced portfolios

5. Can negative interest or withdrawals be included?

Yes. The advanced version supports withdrawals, simulating real-life financial situations.

Final Thoughts

The Advanced Compound Interest Calculator helps you visualize how savings and investments grow over time. Whether you’re planning for retirement, comparing financial products, or estimating future wealth, this tool gives you clear, accurate, and actionable results instantly.

Use it regularly to plan smarter, invest better, and mak

.