Estimated Annuity Calculator

Managing annuity payments or planning long-term savings can be challenging without accurate calculations. Whether you are planning for retirement, evaluating an investment, or calculating loan repayment, knowing your estimated monthly payment, total payments, and interest is crucial. Our Estimated Annuity Calculator is designed to provide a clear, reliable, and user-friendly way to determine these figures in seconds.

This page will guide you through how the calculator works, explain the underlying formulas, and provide practical examples to help you make informed financial decisions.

What Is an Estimated Annuity Calculator?

An annuity calculator is a tool that computes the periodic payment (usually monthly) required to repay a principal amount over a fixed term at a specified interest rate. An annuity can be used for multiple purposes:

- Retirement planning – Estimating fixed monthly income from a lump sum

- Loan repayment – Calculating how much to pay monthly to clear a loan

- Investment evaluation – Understanding total returns over time

By entering the principal amount, annual interest rate, and term, the calculator provides an accurate monthly payment estimate and shows the total amount paid and total interest.

Unlike rough estimates or spreadsheets, this calculator performs precise annuity formula calculations, making it a reliable financial tool.

How to Use the Estimated Annuity Calculator

Using the calculator is simple and requires only three inputs:

- Principal Amount – Enter the total loan or investment amount in dollars. This is the amount you are borrowing or investing.

- Annual Interest Rate – Input the yearly interest rate as a percentage (e.g., 5%). The calculator converts it into a monthly rate for accurate computation.

- Term (Years) – Enter the total period of the annuity in years. The calculator will multiply this by 12 to determine the total number of monthly payments.

Once you click Calculate, the tool instantly provides:

- Estimated Monthly Payment

- Total Payment Over Term

- Total Interest Paid

You can also use the Reset button to clear all fields and start fresh. The tool is mobile-friendly and works perfectly on desktops, tablets, and smartphones.

Understanding the Results

1. Monthly Payment

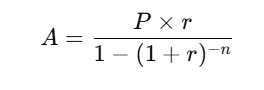

This is the fixed payment you need to make each month. It is calculated using the standard annuity formula:

Where:

- (A) = Monthly payment

- (P) = Principal amount

- (r) = Monthly interest rate (annual rate ÷ 12)

- (n) = Total number of payments (term × 12)

The formula ensures that each payment covers both interest and principal, gradually reducing the outstanding balance over time.

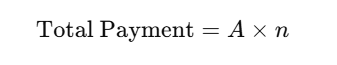

2. Total Payment

This represents the total amount you will pay over the life of the annuity. It is simply:

This helps you plan your budget and understand the full cost of borrowing or investing.

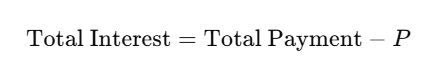

3. Total Interest

Total interest is the difference between total payments and the principal:

This figure shows how much extra you are paying for borrowing or the growth generated in the case of investments.

Example: Using the Calculator

Suppose you want to borrow $100,000 at an annual interest rate of 5% for a 20-year term.

- Principal: $100,000

- Annual Interest Rate: 5%

- Term: 20 years

Using the calculator, you would get:

- Estimated Monthly Payment: ~$659.96

- Total Payment: ~$158,390

- Total Interest: ~$58,390

This quick calculation allows you to plan ahead, avoid surprises, and make confident financial decisions.

Benefits of Using the Calculator

- Accuracy – Avoid manual errors and get precise monthly payment calculations.

- Time-saving – Instant results in seconds.

- Budget Planning – Understand monthly obligations and interest cost.

- Investment Analysis – Evaluate potential returns from annuities or loans.

- User-friendly – No need for advanced math knowledge; intuitive interface.

FAQs

Can I change the interest rate or term?

Yes, you can adjust the principal, interest rate, or term anytime to see how it affects your payments.

Does this calculator work for loans or retirement annuities?

Yes, it works for any fixed-rate annuity calculation, including loans, investments, or retirement income plans.

Are the results exact?

The calculator uses standard annuity formulas for precise estimates. For legal or financial planning, consult a certified financial advisor.

Why Trust Our Estimated Annuity Calculator?

This tool is designed with financial expertise and reliability in mind. It is:

- Accurate – Built using proven annuity formulas

- Transparent – All calculations are based on standard financial principles

- Helpful – Clear results with explanations for better understanding

We aim to empower users with actionable financial insights, backed by trustworthy, expert knowledge.

Final Thoughts

Whether you are planning a loan, an investment, or a retirement annuity, using a reliable calculator is critical. Our Estimated Annuity Calculator offers clear, accurate, and actionable results instantly. By combining modern interface design, easy-to-understand outputs, and precise calculations, this tool ensures that financial planning is simple, stress-free, and accurate.